Commercial real estate investment is attractive for a number of reasons. In addition to tax breaks, CRE investors earn comparatively high ROI compared to other options. Many also enjoy steady income from tenants paying rent.

As a result, it’s no surprise that many people are interested in investing in CRE. Whether diversifying a portfolio or breaking into investing for the first time, CRE offers opportunities in multiple industries. These include multi-family housing, industrial, retail, office, and more.

Additionally, the recent introduction of crowdfunding to CRE has made investing more accessible than ever before. With low minimums and fees, crowdfunding makes it possible for those who may not have the equity and/or cash to invest with traditional methods to join in.

However, before diving into CRE investing, there are a few things to be aware of. Here are three important things to know:

1. Preparation is Key

There’s an old piece of advice that you shouldn’t invest any more than you can afford to lose. And while no one wants to imagine losing their investment, this advice also works on another level. Investing only after all critical expenses, savings, and debts are covered ensures that if anything goes wrong, an investor won’t be left completely high and dry financially.

So, take care of necessities first, then consider additional measures to lower your risk. Many investors set aside additional funds to cover unexpected costs associated with owning and managing commercial property. Expenses can come in the form of management changes, new zoning laws, setbacks during building or renovation, or any other number of things. No one can predict the future, but they can prepare for the unexpected. Research contingency and capital reserve funds to better understand how to prepare for any investment outcome.

Lastly, whether buying to own or investing through another source, be prepared for things to take longer than expected. Just as investors can’t always predict all the costs associated with investing, so too do they often underestimate how long building, introducing new systems, or getting approval takes. If things don’t happen quickly, it’s important to have the cash on hand to remain comfortable until returns start rolling in.

2. Timing is Everything

When thinking about investing, it’s important to consider the current economy and which CRE industries stand to do well in it. For example, the recent rise of online shopping means demand for retail properties has taken a hit. Meanwhile, demand for industrial spaces like warehouses, factories, and even data storage and processing centers is flourishing.

Investing in hotels shortly before a recession, when consumers are likely to cut back on travel spending, could result in a significant loss. At the same time, playing it safe with multifamily housing in established cities can mean lower returns. As with any investment, reward tends to correlate with risk. Carefully inspect economic indicators before making a decision.

Lastly, just as with the stock market and residential real estate investing, CRE goes through cycles. Lack of understanding about these cycles could mean accidentally buying when the market is at a peak, leaving an investor potentially forced to sell low. In addition to knowing specific industry opportunities available in the moment, it’s also important to understand this bigger picture.

3. Commercial Real Estate Investment is Changing

In addition to crowdfunding, recent developments in CRE technology and inclusion are changing the way investors operate. Crowdfunding means once-exclusive opportunities are now available to a larger population. This can create healthy competition that requires staying on top of the latest trends and developments.

Artificial intelligence, communication tools, and virtual/augmented reality are also shaping CRE investing, affecting everything form marketing and leasing to buying and selling. These technologies and crowdfunding combine to make CRE investing more accessible, and therefore equitable. As a result, a more diverse generation of investors and CRE professionals is finally emerging. This also means more perspectives, more creativity, and more competition for those looking to take a piece of the CRE pie.

Despite the change, many things remain the same. Investors must continue to perform their own due diligence before making major financial decisions. It’s important to seek and analyze all available information about a property and related financial considerations before committing to investing. This is best done with a team of trusted advisors, especially ones with experience in CRE. In particular, having many sources of dependable information helps guard against falling for inflated valuations that can tempt investors into committing to high-risk properties.

4. How to Get Started

In the past, limited knowledge about CRE investing and the high costs associated with it acted as barriers for new investors. Today, technology provides all the information and cost-sharing opportunities needed to overcome those hurdles.

Whether Borrowing, Investing or Owning, Get Experience in Your Corner.

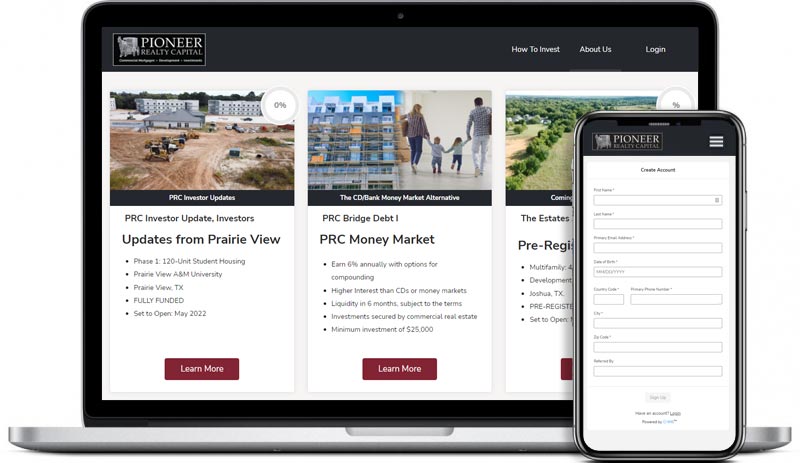

When considering CRE financing or investment, it’s important to have knowledgeable advisors on your side. Experienced professionals such as those at Pioneer Realty Capital offer advisory, crowdfunding, and a network of over 790 capital partners to create creative, cost effective solutions. To find answers to your CRE investment or financing questions, reach out today.

INVEST WITH AN INSIDER

You have an insider on your team and on the ground to help you navigate commercial property ownership or investment. Charles Williams and the team at Pioneer Realty Capital have consistently delivered value and service for over 20 years. You can leverage that experience along with our relationships to reach your financial goals. Investing with an insider has never been easier.

Get Social